2024 was a challenging fund year

- German fund industry with record assets

- Retail funds: inflows significantly above 2023

- Top sellers: bond funds and equity ETFs

- Spezialfonds: new business at low level

‘2024 was a challenging fund year,’ says Matthias Liermann, President of the German Investment Funds Association BVI. ‘Geopolitical tensions, all-time highs on the equity markets despite economic uncertainty and first interest rate cuts dominated the year. Given this situation, the industry recorded a respectable new business with EUR 60 billion in funds and mandates and reached record assets of some EUR 4,500 billion at the end of 2024.’ The German fund market once again confirms its leading position in Europe. According to the European Central Bank (ECB), Germany is the largest fund market with a share of 27%. Germany is also the leader in terms of growth. According to the ECB, the fund assets of private and institutional investors in Germany have increased by an average of 8.2% per year over the last ten years, which is significantly more than in Italy (6.9% per year) or France (4.4% per year), for example.

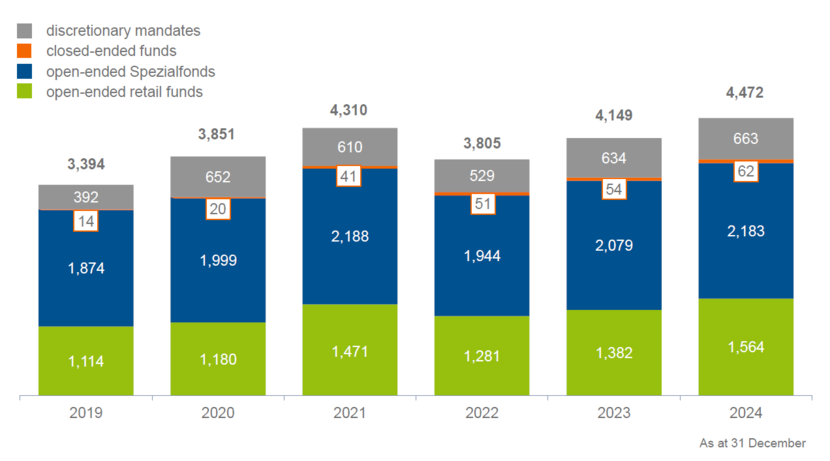

With AuM totalling EUR 4,472 billion, open-ended Spezialfonds are the largest group with EUR 2,183 billion. Retirement benefit schemes (EUR 774 billion) and insurers (EUR 526 billion) account for just under 60% of this total. Fund companies have EUR 1,564 billion AuM in open-ended retail funds.

Net assets of funds and discretionary mandates

in EUR billion

There are EUR 663 billion in mandates and EUR 62 billion in closed-ended funds.

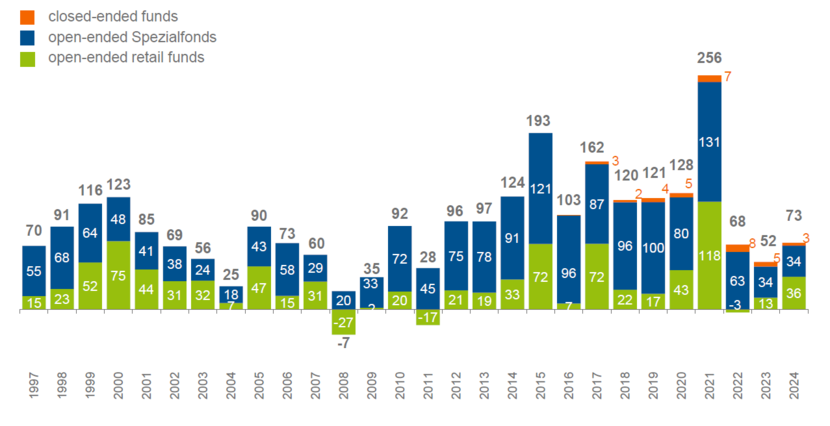

Net sales of funds

no mandates, in EUR billion

At EUR 36.2 billion, new business in open-ended retail funds has picked up compared to the two previous years, when inflows totalled EUR 12.9 billion (2023) and outflows EUR 3.4 billion (2022). According to the Bundesbank, the inflows are primarily due to the increasing demand for retail funds from private investors over the course of the year. The rising number of fund savings plans with ETFs and actively managed funds is ensuring a steady inflow. ‘The signals for new business in January are positive, also due to the good performance of the equity markets in the first weeks,’ says Liermann.

Bond funds topped the sales list of retail funds with EUR 27.4 billion. This is the highest figure since 2012, when they received EUR 33 billion. In 2024, funds that invest in bonds with short maturities (up to three years) dominated the picture. They received EUR 19.4 billion. Regardless of the investment focus, bond ETFs received EUR 9.4 billion. Overall, bond funds had EUR 244 billion under management as of 31 December 2024, which is EUR 36 billion more than at the beginning of the year (EUR 208 billion).

Equity funds attracted EUR 14.7 billion in net new money. While outflows from actively managed funds totalled EUR 7.5 billion, equity ETFs recorded inflows of EUR 22.2 billion. The situation in Germany echoes developments in Europe and worldwide, where ETF sales reached record levels. Investors are increasingly focussing on passive funds to replicate the performance of the respective index. In addition, advisors are increasingly turning to ETFs in their asset management. With a share of 47%, equity funds are the largest group of retail funds in terms of volume. They had EUR 736 billion. Their assets increased by 18% in 2024.

The outflows of EUR 9.7 billion from balanced funds continued from the previous year (2023: minus EUR 15.5 billion). One reason is that investors who gained access to equities via balanced funds in recent years have switched to actively or passively managed equity funds. Furthermore, interest-oriented savers have reallocated their investments to bond funds or day-to-day money, for example. As a result of the high share of equities in balanced funds, their assets grew from EUR 338 to 362 billion over the course of the year.

Property funds saw an outflow of EUR 5.9 billion. This reflects the fund investments cancelled by savers twelve months earlier. In the final quarter of 2024, the funds recorded outflows of EUR 1.9 billion, after EUR 1.9 billion had also flowed out in the third quarter. Property funds, which generally have high occupancy rates and are widely diversified by type of usage and location, reached AuM totalling EUR 123 billion.

With inflows of EUR 33.6 billion, new business in open-ended Spezialfonds remained at the low level of the previous year (EUR 33.7 billion). One reason for the reluctance to invest is the return of interest rates. Institutional investors have obviously increased their direct investments in corporate bonds with good credit ratings and government bonds in recent years. In addition, the capital requirements of some investor groups of Spezialfonds, such as retirement benefit schemes, have increased due to higher payout obligations.

Download Press release (PDF)